Definition of Collusion

Collusion refers to acts where internal or external personnel of the company use illegal or improper means, such as fraud, conspiracy, or collaboration, to seek personal illicit gains at the expense of the company.

Main Forms of Collusion

1. Receiving or offering bribes or kickbacks.

2. Diverting business opportunities that could generate legitimate profits for the company to third parties.

3. Illegally embezzling or misappropriating company assets for personal gain.

4. Selling non-existent or falsified assets to embezzle company funds.

5. Facilitating payments for fictitious transactions on behalf of the company.

6. Forging or altering accounting records or financial documents and providing false financial reports or evading taxes.

7. Intentionally concealing or misreporting transaction information, resulting in false records, misleading statements, or significant omissions in disclosures.

8. Colluding with related organizations or personnel to obtain price, technical, or other sensitive information for personal gain.

9. Manipulating bid prices during procurement and bidding processes to the detriment of clients.

10. Engaging in other forms of collusion that harm the company’s economic interests.

Prohibition of Collusion and Conspiracy Between Internal and External Personnel

The company strictly prohibits any form of collusion or conspiracy involving internal and external personnel, including but not limited to the following:

1. Prohibition of Internal-External Collusion

Paying invoices that are falsified or obtained through collusion with suppliers.

Colluding with suppliers to increase invoice amounts.

Misusing supplier orders to make the company pay for personal purchases.

2. Prohibition of Payroll Fraud

Including false overtime hours, inflated wage rates, or excessive working hours in the payroll.

Continuing to pay wages to employees who have resigned.

Inflating payroll expenses or withholding wages that have not been collected.

3. Prohibition of Kickbacks and Unfair Deals

4. Prohibition of Concealing Receivables

5. Prohibition of Misappropriation of Cash Receipts

Using fictitious expenses to reduce cash sales revenue.

Treating recovered bad debts as off-the-books funds or pocketing the cash for personal use.

Making payments that are unnecessary, diverting these payments as off-the-books funds, or embezzling the funds for personal use.

6. Prohibition of Tampering with Financial Records

Forging, altering, or destroying (tearing up) cash sales records to divert cash receipts.

Using photocopies of original documents that have already been used or altering the dates on documents.

7. Prohibition of Abuse of Authority

Taking advantage of one's position to solicit improper benefits, such as money or valuable items, from subordinates.

These rules are intended to protect the company’s interests and ensure ethical business practices. Violations will be subject to disciplinary actions, including but not limited to termination of employment, legal action, or prosecution under applicable laws.

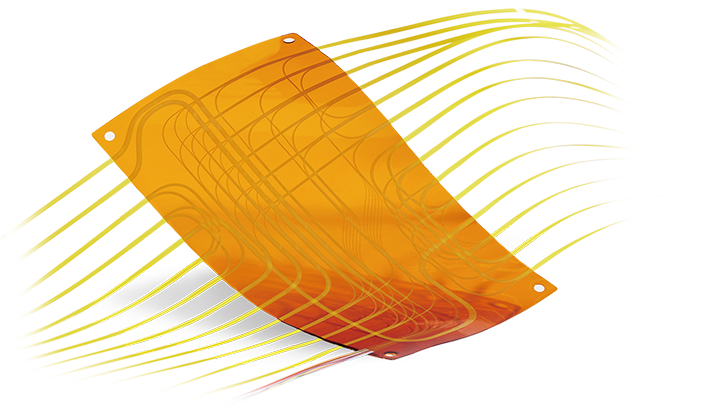

Fiber Optic Flex Circuit (FOFC)

Advanced Simulation & Optimization, High Positioning Accuracy, Flexible Customization, Rigorous Reliability Testing

Fiber Optic Flex Circuit (FOFC)

Advanced Simulation & Optimization, High Positioning Accuracy, Flexible Customization, Rigorous Reliability Testing MDC Solution

US Conec's MDC connector is a Very Small Form Factor (VSFF) duplex optical connector, expertly designed for terminating single-mode and multimode fiber cables with diameters up to 2.0mm.

MDC Solution

US Conec's MDC connector is a Very Small Form Factor (VSFF) duplex optical connector, expertly designed for terminating single-mode and multimode fiber cables with diameters up to 2.0mm. MMC Solution

US Conec's Very Small Form Factor (VSFF) multi-fiber optical connector that redefines high-density connectivity with its cutting-edge TMT ferrule technology and intuitive Direct-Conec™ push-pull boot design.

MMC Solution

US Conec's Very Small Form Factor (VSFF) multi-fiber optical connector that redefines high-density connectivity with its cutting-edge TMT ferrule technology and intuitive Direct-Conec™ push-pull boot design. EN

EN

jp

jp  fr

fr  es

es  it

it  ru

ru  pt

pt  ar

ar  el

el  nl

nl